Climate Week NYC 2024 is upon us and finance remains a common theme across many net-zero transition debates. Great strides have been made in renewable technology and capacity to date. Yet, more investment is urgently needed to build the net-zero economy by mid-century.

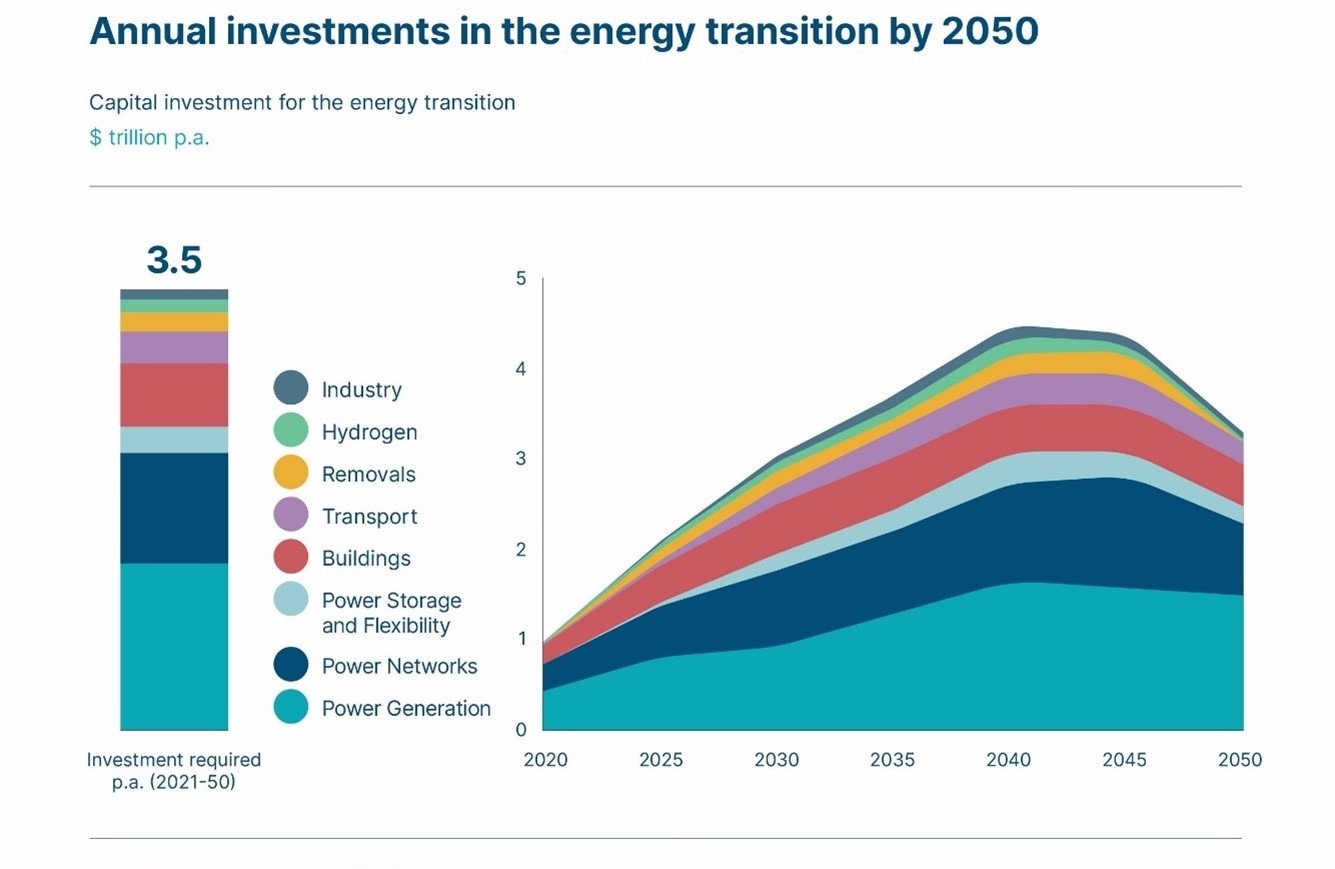

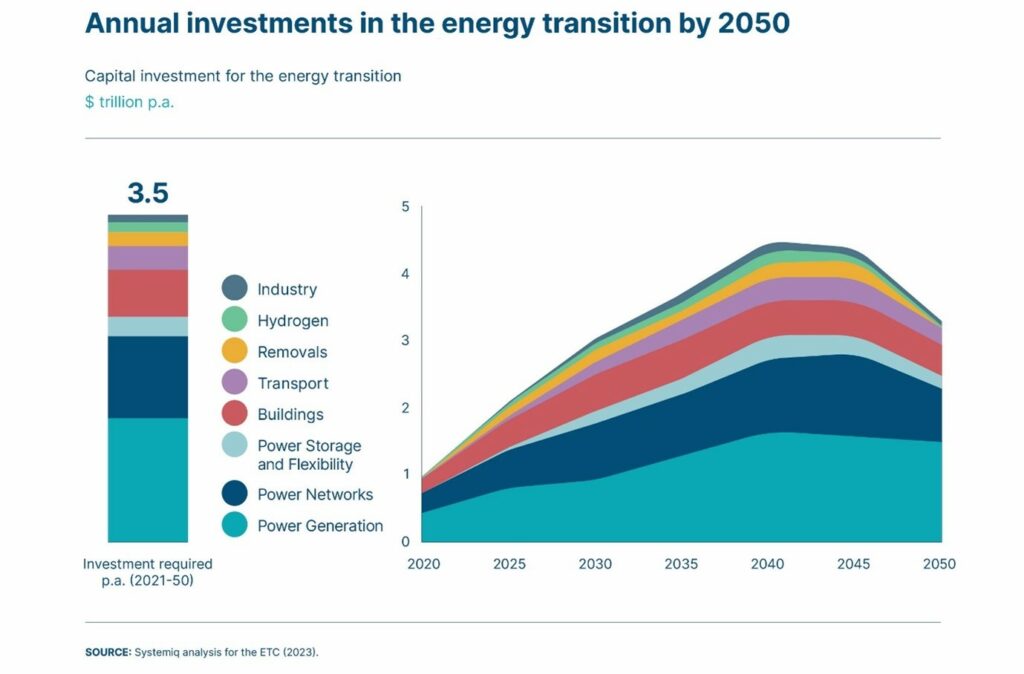

The ETC’s 2023 Financing the Transition report states that on average, total global capital investment to the scale of $3.5 trillion per year is required for the energy transition. Building on this analysis, we turn our focus to a sub-set of three investment positive policies referenced in this work. ‘Investment positive’ policies are defined as those where low-carbon solutions (such as renewable power generation and electric vehicles) are already cheaper than fossil fuels.

Success in the transition so far has been largely driven by industry’s response to ambitious government targets to accelerate deployment and drive down costs. Amplifying and extending these policies around the world could scale investment to $1 trillion of the $3.5 trillion per annum required to transition the energy sector in line with limiting global warming to 1.5°C:

- Set gigawatt (GW) targets for renewable energy deployment, in line with tripling renewable energy by 2030. At COP 28, nearly 200 countries committed to tripling renewables by 2030. Countries can reinforce this by setting ambitious national level GW deployment targets for renewables.

- De-risk investment in renewable energy e.g. by offering competitive long-term contracts, tax credits or equivalent support (e.g. as in India, EU, US, China). De-risking investment in renewables accelerates the deployment of private capital. Support schemes in many countries are seeing an accelerating in renewable deployment, often at no net cost to consumers.

- Set a strict end date for sales of passenger internal combustion engine vehicles, by 2035 (e.g. as in EU) or 2040 at the latest. In China and the US, the total cost of ownership of battery-electric sport utility vehicles and SUVs powered by internal combustion engines reached parity or near-parity.[1] China electric vehicles are expected to make up around 45-50% of overall vehicle sales this year.

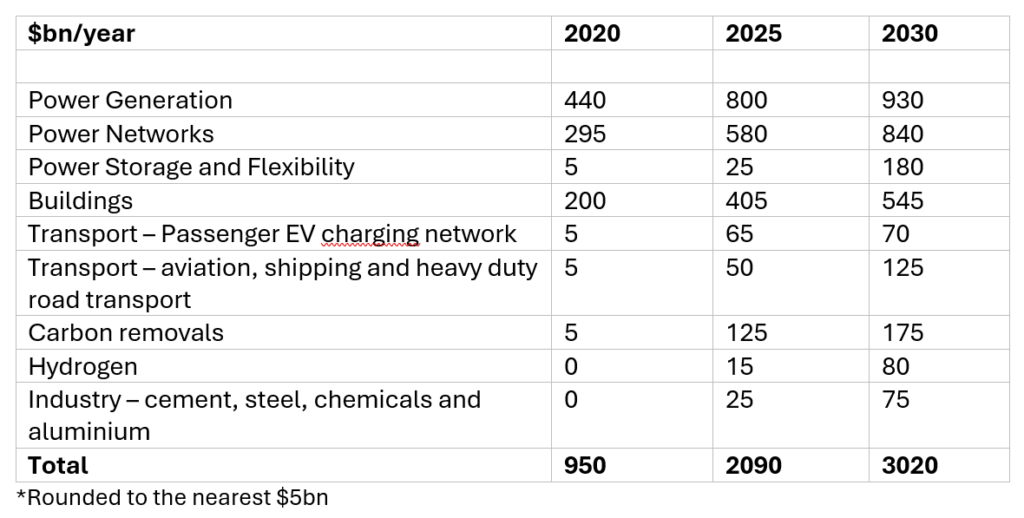

With these three policies in place, annual investment in clean power generation could feasibly reach almost $930 billion globally and for passenger electric vehicles (including electric passenger charging) capital investment could realistically reach $70 billion per year. Totalling $1 trillion in 2030.

Progress to date in technology and policy already implies that ambition in the next round of NDCs can be tripled compared to current NDCs (which were set in 2020), as set out in the ETC’s recent report Credible Contributions.[2]

Further policy support can help to meet the $3.5 trillion investment required, and accelerate the transition.[3] The total investment required for the clean energy transition will be offset by an average annual reduction of $0.5 trillion in fossil fuel investment to give a net investment requirement of $3 trillion per annum, equivalent to 1-1.5% of prospective global gross domestic product (GDP) over the next 30 years.[4]

The table below details the estimated average annual investment requirements by sector between 2020-2030.[5]

Read the ETC’s Financing the Transition report and Credible Contributions report on raising the ambition in the next round of NDCs for deeper insights. We will also be publishing a short paper in October 2024 combining insights from these reports and explaining key issues in the climate finance debates leading into COP29.

We also published five sector policy toolkits, explaining how much finance is required for the clean transition of Power, Transport, Hydrogen, Buildings, and Heavy Industry sectors.

At New York Climate Week, Mission 2025 will build on these findings and formally ask governments to set the investment-positive policies that will give private capital the confidence to invest at scale in the energy transition. Mission 2025 is a global coalition representing a partnership of over 70 organizations across the climate action ecosystem, as well as multinational businesses, including Allianz, Fortescue, Ikea, Polestar, SAP and Unilever.

[1] US: TCO of BE-SUVs was 1% lower than that of ICE-SUVs, China: TCO of BE-SUVs was 2% higher than that of ICE-SUVs. BloombergNEF (2023), Long-term Electric Vehicle Outlook.

[2] ETC (2024), Credible Contributions: Bolder Plans for Higher Climate Ambition in the Next Round of NDCs.

[3] Chapter 2 of Financing the Transition outlines these policies in greater detail.

[4] The $0.5 trillion is the difference between current investment in fossil fuels ($0.8tr) and projected average annual investment in fossil fuels 2021-50 ($0.3trn). Source: BloombergNEF (2022), Counting Cash in Paris Aligned Pathways – analysis based on IEA Net Zero scenario.

[5] Investment estimates for power are gross totals based on the total generation and network required for a net-zero economy. Estimates in the other sectors are the net, incremental investment required over and above what would otherwise occur in a BAU. For this reason, the estimates on transport only include the investment required to develop charging infrastructure and not the cost of EVs.