Published July 2023

The Energy Transitions Commission gathers its members, leaders from across the energy, industry and finance landscape, several times a year to align on its analytical direction and share progress. For our recent meeting in July, the ETC team distilled 5 Key Messages on the Energy Transition reflecting the current state of progress. We are now also sharing these publicly, as a contribution to the debate.

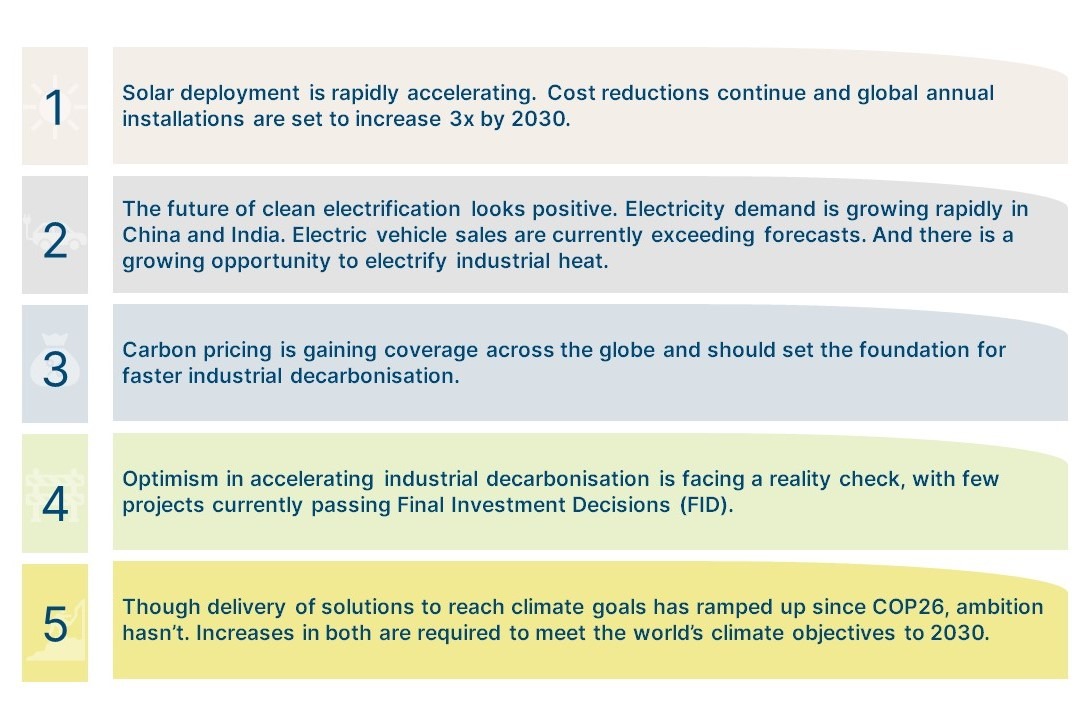

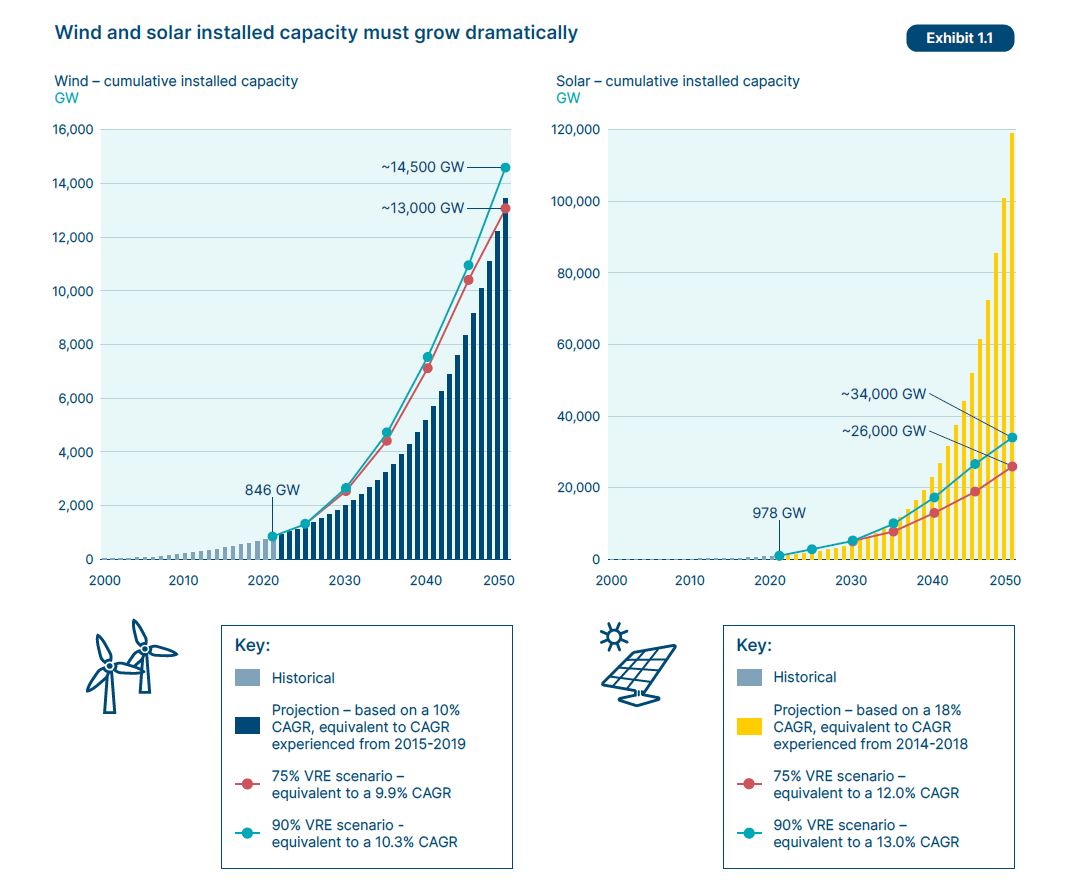

Key Message #1: Solar deployment is rapidly accelerating. Cost reductions continue and global annual installations are set to increase 3x by 2030.

Context: There is higher penetration of solar vs. wind than previously expected. Forecasted solar capacity exceeds ETC milestones for 2030 due to faster than expected manufacturing capacity growth and innovation in panel modularity. Continuing cost declines for solar and battery technologies improve possibilities for cheaper distributed energy, creating the potential for rapid uptake in Indonesia, India, Africa and other low-latitude countries, and for rapid replacement of diesel generator sets globally.

However, new possibilities for building-mounted and building-integrated PV, have implications for how customers pay for and how operators run the grid. And current solar supply chains remain strongly dependent (over 80%) on China, with associated environmental and social concerns that need to be resolved.

In comparison, wind deployment in countries outside China lags behind as barriers to scale-up are higher and delay roll-out.

ETC Link: The ETC’s Barriers to Clean Electrification series covers Planning and Permitting, Clean Energy Supply Chains and Material and Resource constraints to scaling up. The next in this series will explore Electricity Grids and is expected to launch in Q1 2024.

Key Message #2: The future of clean electrification looks positive. Electricity demand is growing rapidly in China and India. Electric vehicle sales are currently exceeding forecasts.

Context: China leads the renewable energy race. It is anticipated to install a cumulative solar capacity of 1,400 GW, and a cumulative wind capacity of 580 GW more than the EU and US combined by 2030.

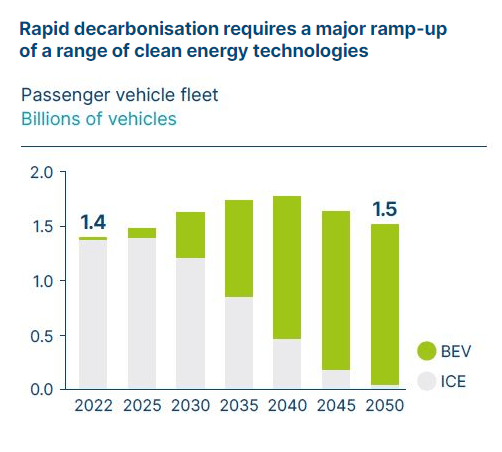

Electric vehicle sales currently exceed forecasts. Strong policies can continue to push this, for example, banning the sale of new Internal Combustion Engine vehicles by 2030.

And there is a growing opportunity to electrify industrial heat. Heat accounts for roughly 50% of global final energy consumption, and around half of this heat is used in industry, often at temperatures of 400°C or higher. Electrification provides a huge opportunity for decarbonising medium temperatures used in industry, but a remaining challenge is the cost of electrification and appropriate storage to enable continuous decarbonised heat.

ETC Link: Scaling up clean electricity technology is featured widely across the Barriers to Clean Electrification series. Electrification of heat is currently being explored in the ETC’s Energy Productivity workstream, with a report expected to publish in 2024.

Key Message #3: Carbon pricing is gaining coverage across the globe and should set the foundation for faster industrial decarbonisation.

Context: Compliance Carbon Markets have grown in revenue and greenhouse gas emissions coverage. In 2020, the total revenue from global emissions trading schemes and carbon taxes equalled around US$54 billion. By 2022, that figure reached US$96 billion.

On a regional level, the passing of the Carbon Border Adjustment Mechanism (CBAM) means that industrial emitters will face strong carbon prices this decade in and outside the EU. Incentives in the US Inflation Reduction Act also provide implicit carbon pricing incentives (e.g., CCUS, H2 credits).

ETC Link: ETC’s Financing the Transition explores how carbon pricing mechanisms can help provide some of the required finance for the energy transition.

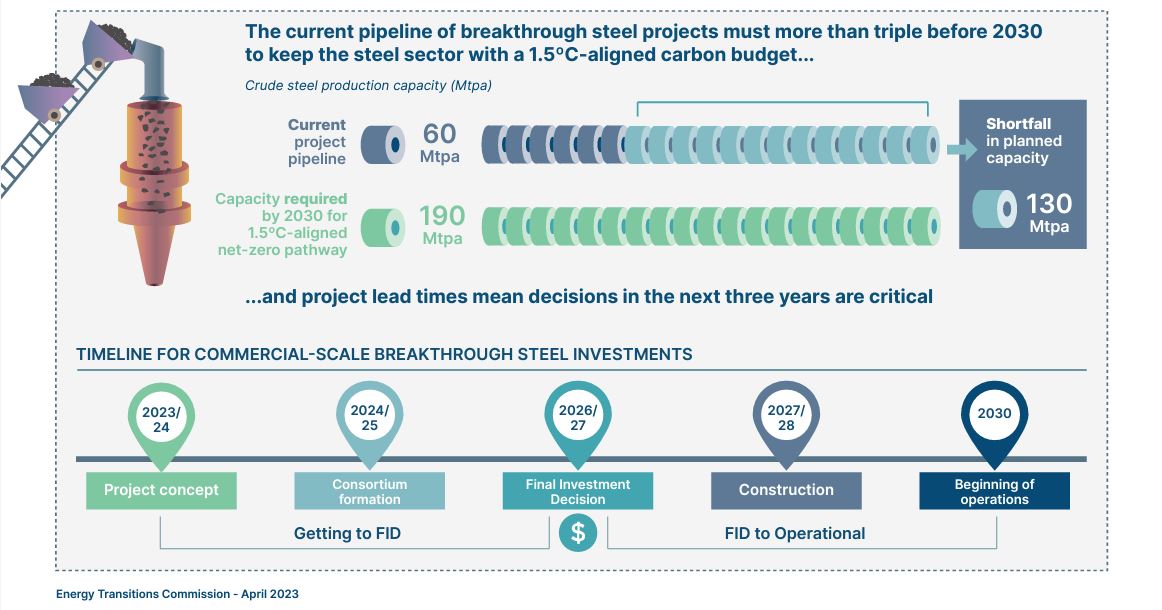

Key Message #4: Optimism in accelerating industrial decarbonisation is facing a reality check, with few projects currently passing Final Investment Decisions (FID).

Context: Policy support for industrial decarbonisation still lacking, particularly outside of the US. China, representing half of the global steel emissions and the largest aluminium producer, has delayed its target year for peak carbon emissions from the non-ferrous metals industry by five years to 2030.

The comparatively high carbon price of the CBAM arriving in 2026 is likely to incite a global compliance market response but is currently not leading to material investment decisions in clean alternatives. Iron and steel are included in the EU carbon border taxation, which is expected to benefit green steel production globally. There are plans to include aluminium imports in this mechanism as well. But the number of FID-approved near-zero emissions steel and aluminium plants is still in single digits, though each requires 70 plants in operation by 2030 to meet targets.

ETC Link: The ETC’s series Unlocking the First Wave of Breakthrough Steel finds that a viable investment case for breakthrough, near-zero emissions steelmaking technology is within reach in four key regions (UK, Southern Europe, France, and US).

Key Message #5: Though delivery of solutions to reach climate goals has ramped up since COP26, ambition hasn’t. Increases in both are required to meet the world’s climate objectives to 2030.

Context: Confidence in the delivery of ambitious climate goals has increased substantially in China, EU and US. China is looking likely to reach an emissions peak in 2026/27, if not before. The EU is close to delivering a 55% emissions reduction. US IRA increases potential reduction to 30-45% by 2030, but still short of 50-52% reduction

However, the global stocktake at COP28 this year is unlikely to reflect material new pledges in ambition as the promised tightening of Nationally Determined Contributions has not happened. In aggregate, current NDCs lead to 2°C warming.

ETC Link: The upcoming Fossil Fuels in Transition report due to publish in October will present the ETC’s view of ambition ahead of COP28.