Unlocking the First Wave of Breakthrough Steel Investments

April 2023

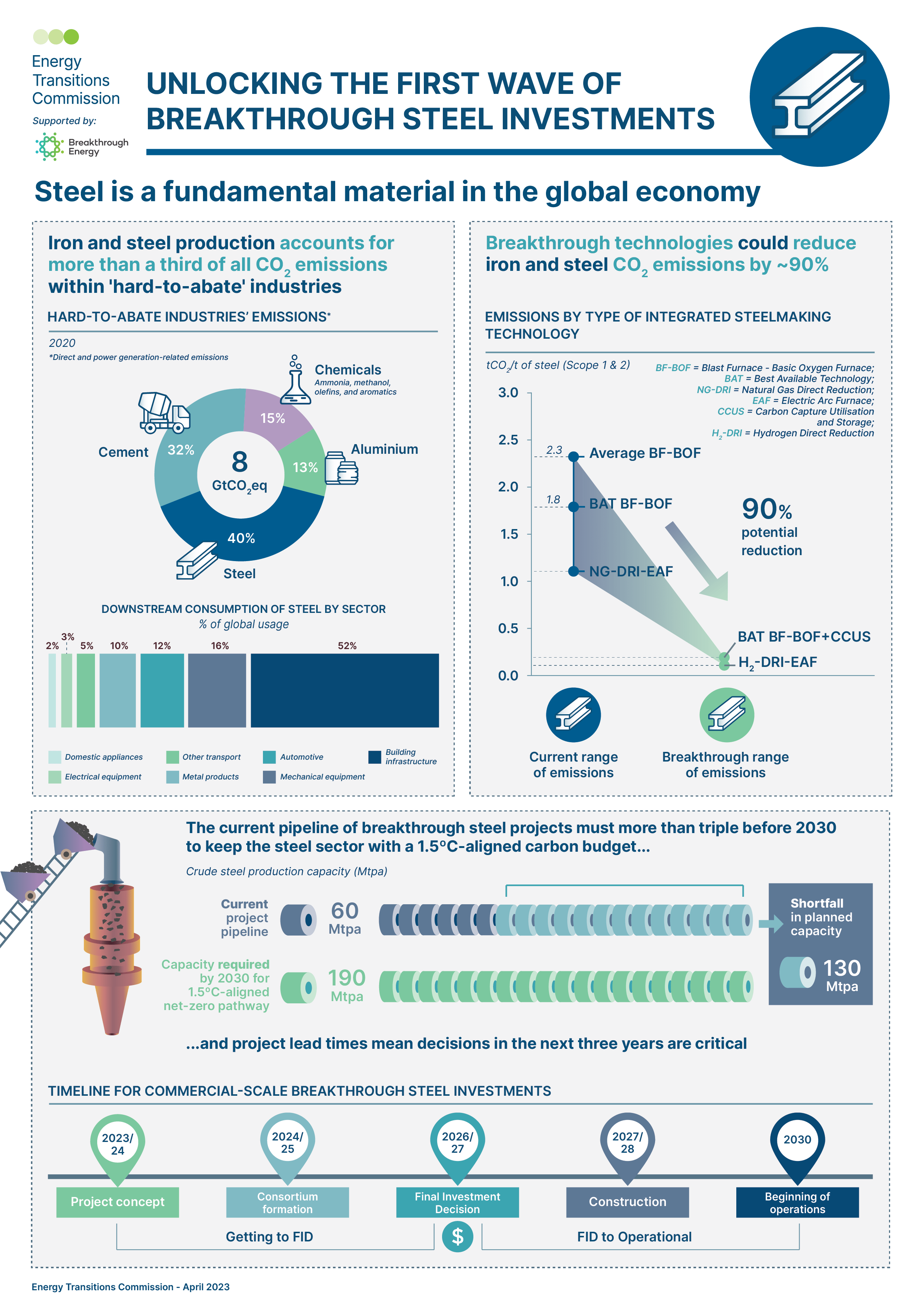

A rapid scale-up in near-zero emissions primary steelmaking is critical for decarbonising steel

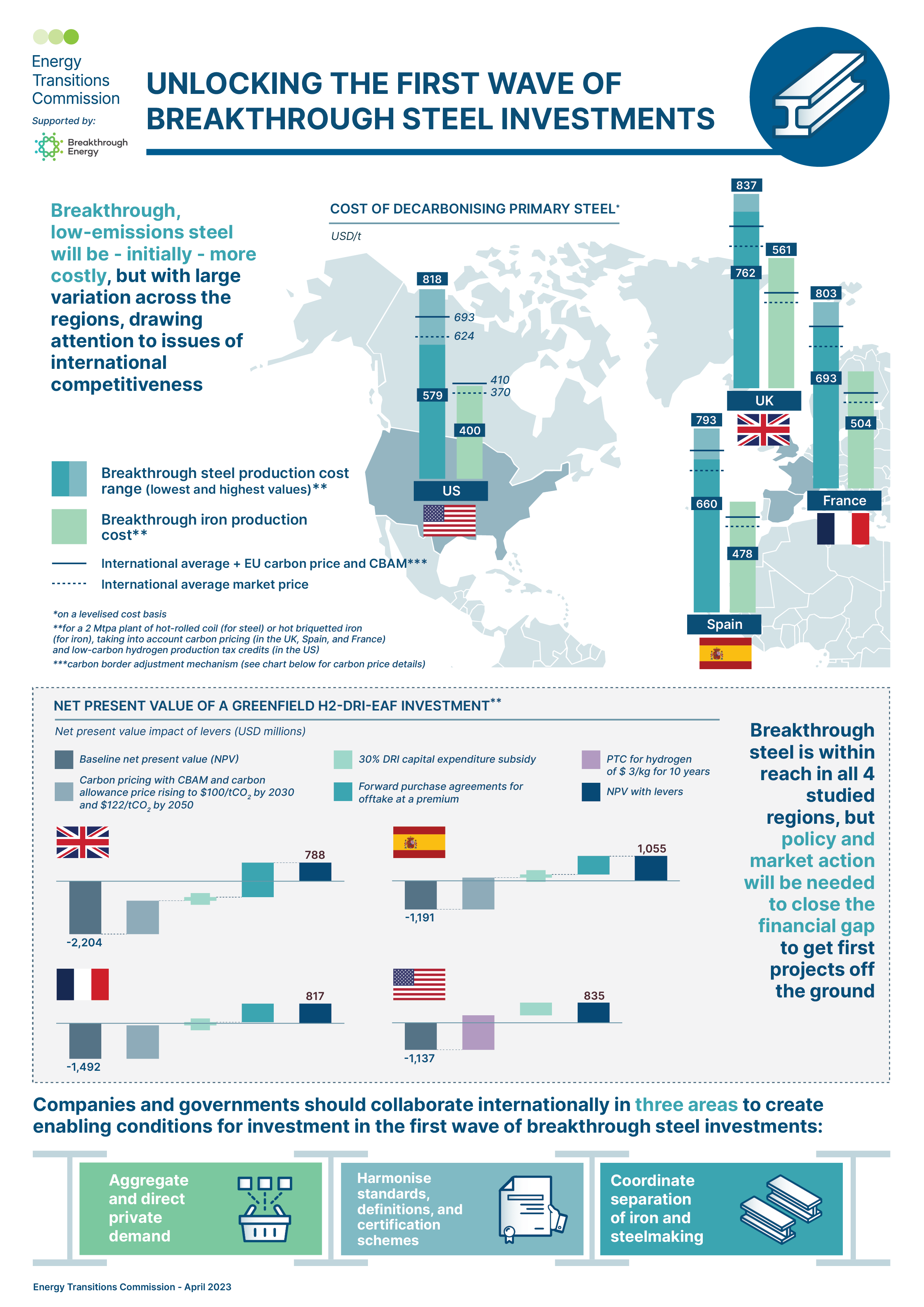

Growing demand for steel and inherent limits to the future supply of scrap steel available for recycling means that as much as 60% of global demand in 2050 may still need to be met by primary (ore-based) steel production. Decarbonising primary production represents an essential lever for achieving a net-zero emissions steel sector.

Expanding the pipeline of commercial-scale, near-zero emissions primary projects and progressing them to final investment decisions (FIDs) in the next five years becomes the critical task for putting the global industry on a 1.5°C-aligned pathway.

Strategic interventions can create a viable investment case for breakthrough, near-zero emissions steelmaking technology

Breakthrough primary steelmaking technology, centred on direct reduced iron (DRI) production with clean hydrogen, is under development at a commercial scale by a handful of projects around the world, but most have yet to reach FID status.

In Europe and North America, a viable investment case for breakthrough projects is within reach in several regions and countries:

United Kingdom: Effective carbon pricing on domestic production and steel imports, lower costs associated with sourcing and processing scrap steel, a market for differentiated low-carbon steel and guarantees to de-risk novel technologies could establish an investment case.

Southern Europe: Effective phase-in of the EU CBAM would put an investment case for breakthrough steel within reach in Spain. Further support, in the form of capital expenditure subsidies or forward offtake agreements at a premium, would strengthen the investment case and unlock greenfield opportunities.

France: Effective implementation of the EU CBAM would lay a robust foundation for breakthrough steel in France. Affordable electricity prices, leveraging the domestic scrap supply, and government funding support could create an investment case for transforming existing emissions-intense sites.

United States: Support from the Inflation Reduction Act for clean hydrogen combined with competitive electricity prices creates a compelling case for breakthrough iron and steel.

Insight and recommendations on a region-specific basis

Unlocking the First Wave of Breakthrough Steel Investments is the product of a series of forums convened by the ETC, with the support of Breakthrough Energy, to foster full-value chain dialogue in different steelmaking regions. Each regional insight report synthesises the analysis and debate to determine what it will take. The international report and infographic bring together and summarise the insights of the regional instalments.

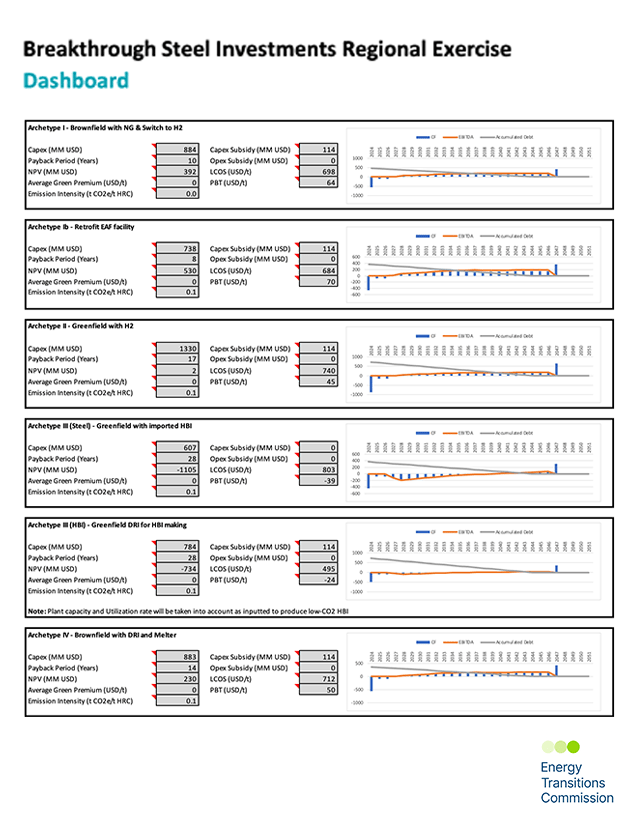

The insight reports are accompanied by the financial tool developed by the ETC to model the financial performance of breakthrough iron and steel project archetypes. A short accompanying Technical Appendix details methodologies and assumptions.

Download the international report