Published April 2023

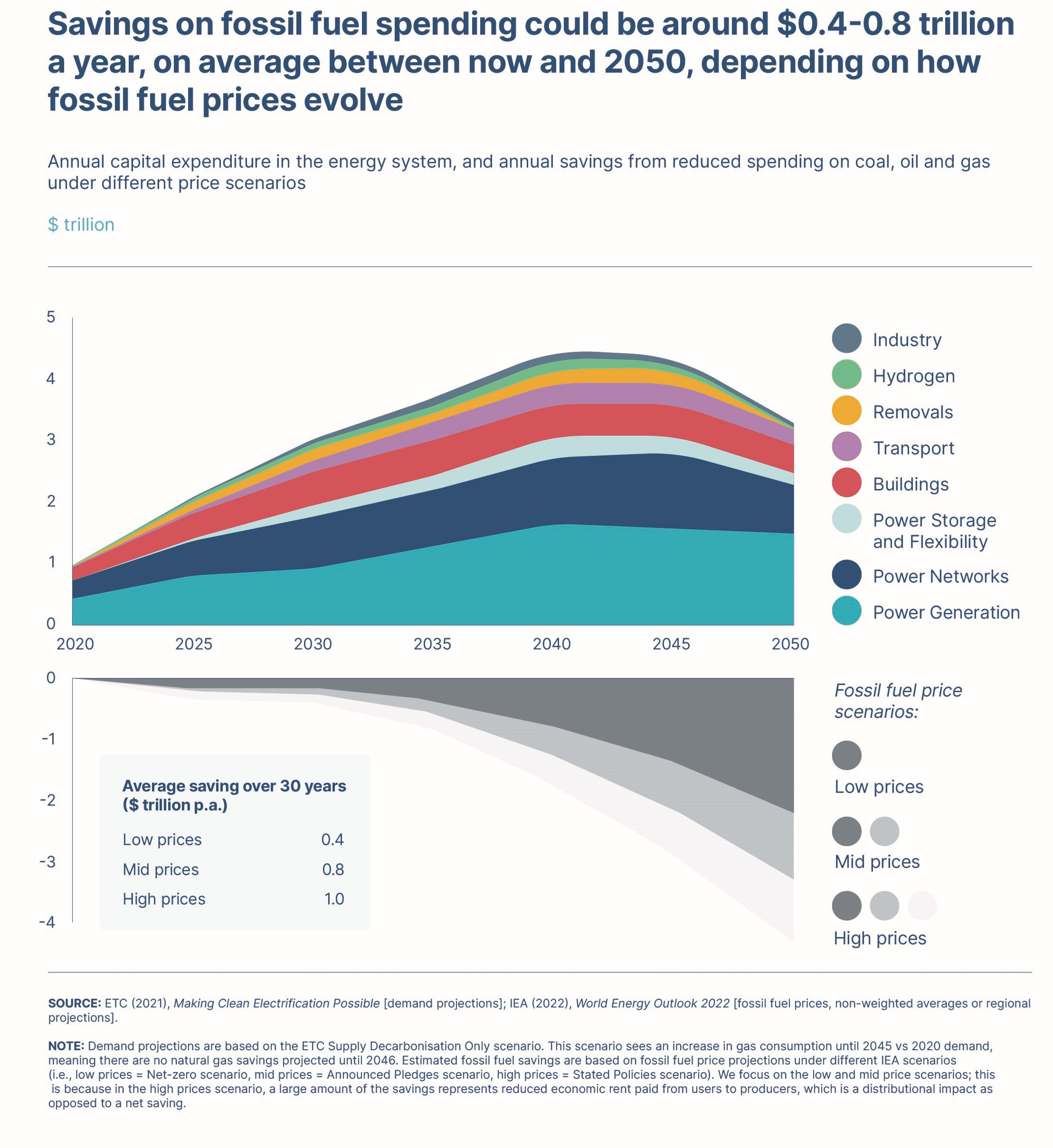

The Energy Transitions Commission gathers its members, leaders from across the energy, industry and finance landscape, several times a year to align on its analytical direction and share progress. At our recent meeting in March, we discussed 6 Key Messages on the Energy Transition reflecting the current state of progress. We are now also sharing these publicly, as a contribution to the debate.

Key message #1: Fossil fuels are close to peaking but have yet to fall. Annual investments in low-carbon energy supply must triple from ~$1trn to ~$3.5trn to accelerate the shift to a net-zero energy system.

Global energy-related CO2 emissions grew by 1% in 2022, reaching an all-time high of 36.8 GtCO2. Despite high prices and a global rush to develop liquified natural gas (LNG) trade capacity, fossil fuel supply investments stayed flat in real terms in 2022, in line with requirements in IEA’s Net-Zero Outlook. For the first time, the IEA expects that current policies alone are sufficient to induce a peak in fossil fuel demand by 2030, as electric vehicles and renewables decrease demand for oil, coal and gas. Further policy action is of course expected and required.

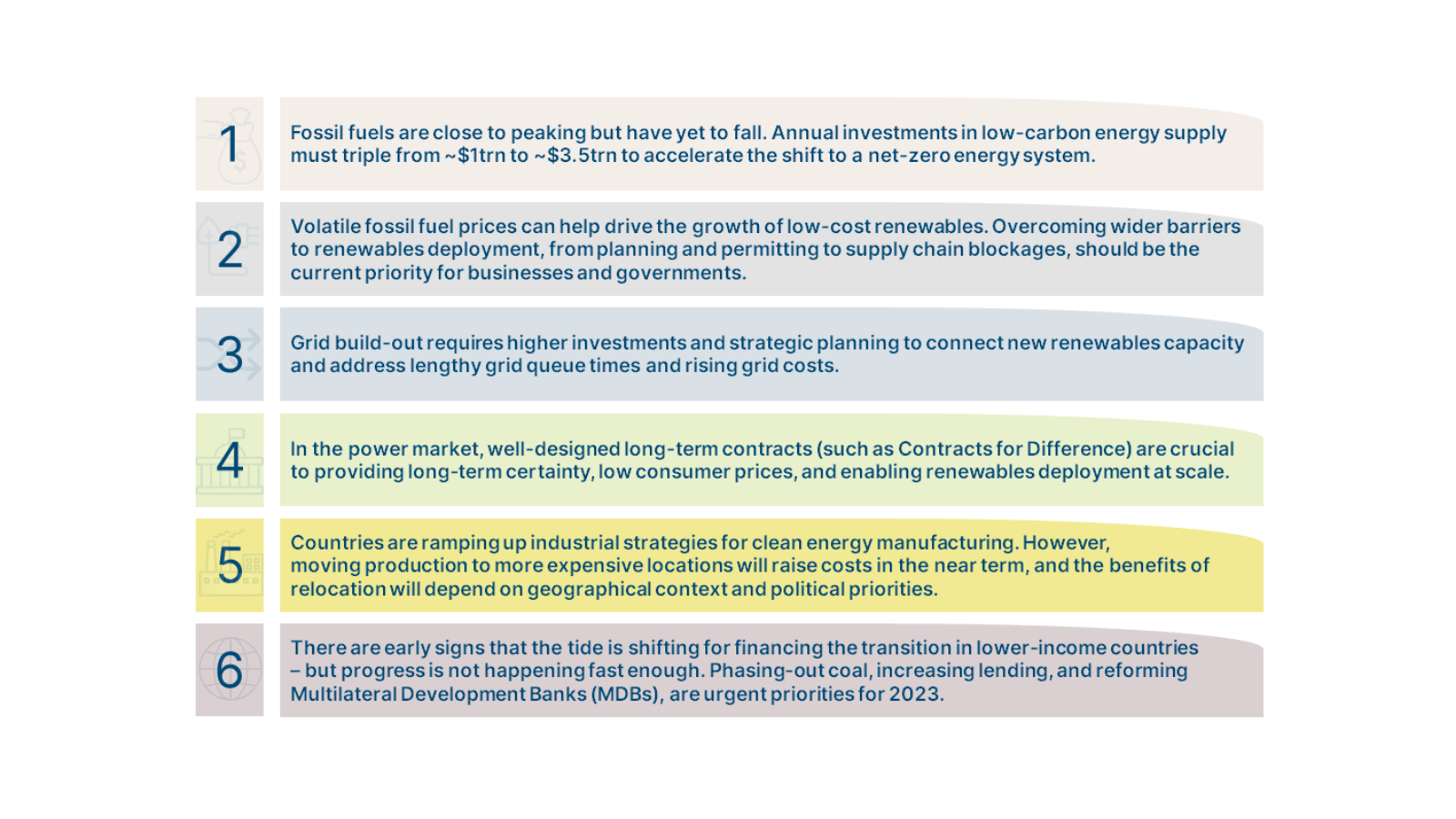

Our latest report, Financing the Transition, estimates that $3.5 trillion per year of capital investment is needed on average between now and 2050 to build a net-zero economy. Part of this investment need could be offset by declining investment in fossil fuels, bringing the annual requirement to a net $3 trillion per year over the next three decades. Our upcoming Fossils Fuels in Transition analysis aims to identify plausible fossil fuels demand pathways on a 1.5°C trajectory.

Key message #2: Volatile fossil fuel prices can help drive the growth of low-cost renewables. Overcoming wider barriers to renewables deployment, from planning and permitting to supply chain blockages, should be the current priority for businesses and governments.

Key message #2: Volatile fossil fuel prices can help drive the growth of low-cost renewables. Overcoming wider barriers to renewables deployment, from planning and permitting to supply chain blockages, should be the current priority for businesses and governments.

Electricity from renewables (solar, wind and hydropower) is set to be the largest source of generation globally by 2025 (IEA). Although commodity prices and financing costs for wind and solar have risen slightly, the increase in coal and gas costs has been much larger than renewables due to rising fossil fuel prices.

The ETC’s Making Clean Electrification Possible report sets out how low-cost renewables could help grow the power system 3-5x from current levels, and our ongoing work on Barriers to Clean Electrification studies the potential blockages to achieving this. We started with Streamlining Planning and Permitting, and the next looks at Clean Energy Supply Chains.

Key message #3: Grid build-out requires higher investments and strategic planning to connect new renewables capacity, and address lengthy grid queue times and rising grid costs.

It is taking longer and becoming costlier for renewables to secure a grid connection, particularly in key markets such as the US and Europe. The US currently has over 1.4 TW of clean power projects waiting for a grid connection; time spent in grid queues nearly doubled between 2010-21, and grid connection costs are also rising. It is estimated that 80% of the potential emissions reductions from the US Inflation Reduction Act (IRA) will be lost if transmission expansion is limited to the current pace of 1% per year.

We will address the issue of network availability in detail later this year as part of our Barriers to Clean Electrification series.

Key message #4: In the power market, there is a small trend away from long-term government de-risked contracts for renewables (delivered via auctions), towards merchant revenue and corporate Power Purchase Agreements (PPAs). However, well-designed long-term contracts (such as Contracts for Difference) are crucial to providing long-term certainty, low consumer prices, and enabling renewables deployment at scale.

Renewable auctions in at least 9 countries went undersubscribed in 2022, due to high spot market power prices, with renewable generators shifting more towards more wholesale market revenue or corporate PPAs (BNEF)1BNEF (2023), Undersubscribed renewable auctions? Not a problem.. However, as wind and solar deployment increases, wholesale electricity prices are likely to become more volatile, with many periods of near-zero prices. Long-term contracts, typically offered via government-backed auctions, will continue to be important to secure future revenue streams for generators in a way that reduces market risk, lowers the cost of capital to build more renewables, and stabilises consumer prices.

Covered in detail in the ETC’s 2021 Making Clean Electrification Possible report.

Key message #5: Countries are ramping up industrial strategies for clean energy manufacturing. However, moving production to more expensive locations will raise costs in the near term, and the benefits of relocation will depend on geographical context, and political priorities around resilience, jobs and value add.

The EU announced a Green Deal Industrial Plan in February in response to the US’s Inflation Reduction Act announced last year, which includes the Net Zero Industry Act and the Critical Raw Materials Act. This plan aims to create a regulatory environment in the EU that grows manufacturing capability of net-zero technologies supported by a secure, affordable, and sustainable supply of raw materials that minimises Europe’s reliance on imports.

These considerations will be addressed in the Clean Energy Supply Chains workstream, part of the Barriers to Clean Electrification series.

Key message #6: There are early signs that the tide is shifting for financing the transition in lower-income countries – but progress is not happening fast enough. Phasing-out coal, increasing lending, and reforming Multilateral Development Banks (MDBs), are urgent priorities for 2023.

Since COP27, momentum has grown for mobilising finance in lower-income countries, driven by the Bridgetown Agenda and Energy Transition Accelerator proposals. New ideas include expanding the role of the IMF’s Special Drawing Rights and accelerating coal phase-out through voluntary carbon markets. Reform of the MDB system is also gathering pace, with the World Bank seeking more money from its shareholders and changing its risk tolerance to boost its lending capacity, freeing another $4bn a year.

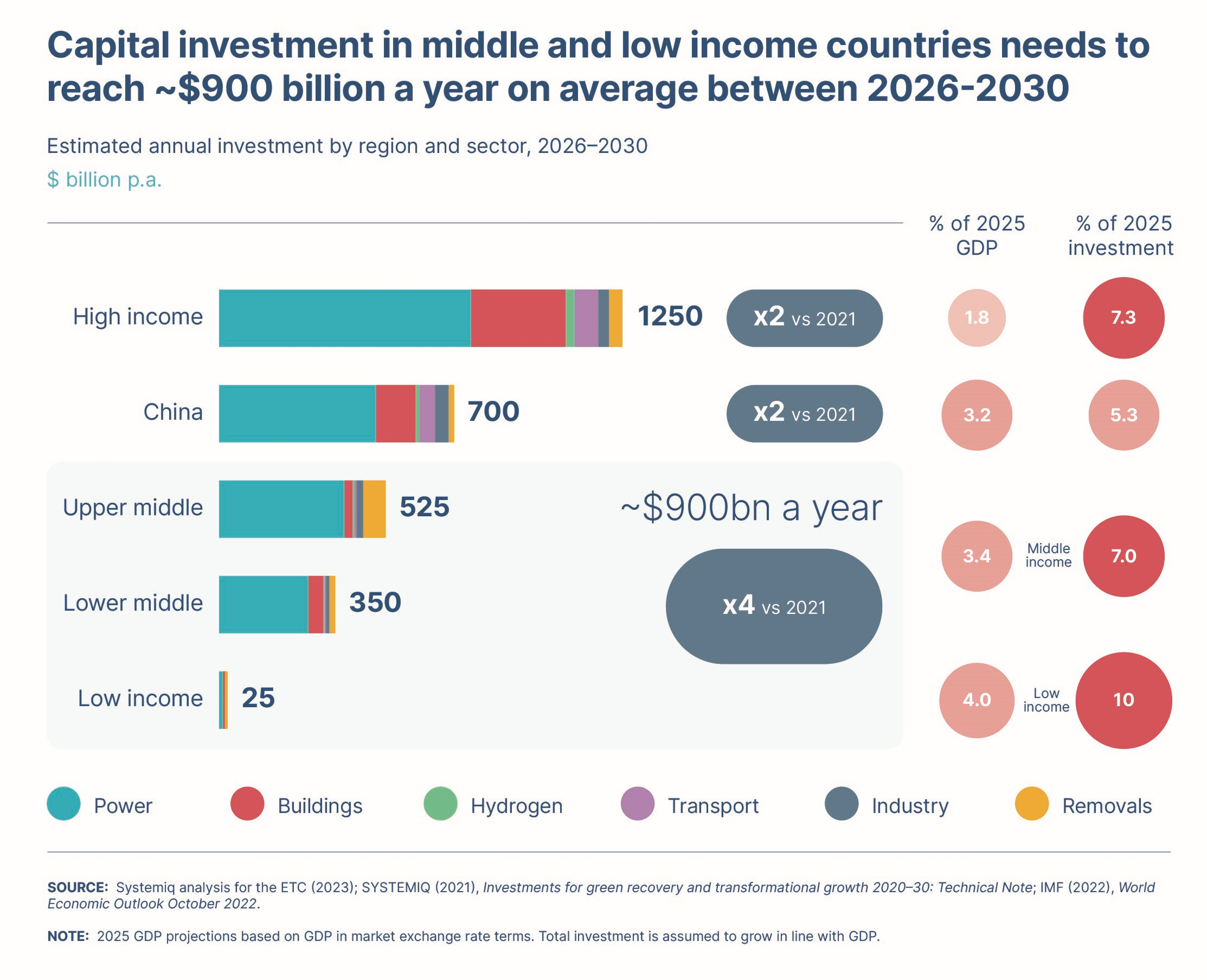

Our Financing the Transition report builds upon the growing literature in this space and clarifies the key issues. We estimate that low-carbon investment in middle- and low-income countries (excluding China) needs to quadruple to reach $900bn a year by 2030 to accelerate the energy transition.

Governments and businesses play a large role in delivering the needed investment in renewables and creating enabling conditions for construction. Cheap renewables and the growing momentum of finance flows are shifting the world away from reliance on fossil fuels. However, the current speed and scale of the global energy transition are not enough to keep the world on the pathway to limiting global warming to 1.5°C. These key messages highlight areas for high-priority action.

Governments and businesses play a large role in delivering the needed investment in renewables and creating enabling conditions for construction. Cheap renewables and the growing momentum of finance flows are shifting the world away from reliance on fossil fuels. However, the current speed and scale of the global energy transition are not enough to keep the world on the pathway to limiting global warming to 1.5°C. These key messages highlight areas for high-priority action.

Coming in June is the ETC’s Insights Briefing on Clean Energy Supply Chains, part of the Barriers to Clean Electrification Series, which identifies bottlenecks in critical supply chains and recommends solutions.