Get to know our members and what being part of the ETC means to them.

Today our focus is on HSBC and their Centre of Sustainable Finance. We hear from the Managing Director & Group Head of the HSBC Centre of Sustainable Finance, Zoë Knight.

-

What drew your organisation to join the ETC?

We joined the ETC relatively early in its life, in 2017, because we wanted to understand more about how climate science would translate into real-life energy system changes. In 2017 we announced a sustainable finance goal of $100bn by 2025. We knew that a critical climate solution was to scale up renewables and increase energy efficiency, but we really wanted to get into the detail of how a global transformation in emissions profiles could be achieved across industry and transport, as well as for power. For that, we needed pioneer academic and industry thinking. The ETC brought together the perfect composition of expertise to drive an energy system vision, consistent with limiting temperature rises.

-

What do you think is the ETC’s most impactful achievement since you’ve been a Commissioner?

It has to be the Mission Possible Series. This technical work showed how to decarbonise the industrial sectors that together represent 30% of energy emissions today and could increase to 60% by mid-century as other sectors lower their emissions, yet also provide infrastructure and goods central to our needs. It moved the finance conversation forward from thinking about the renewable opportunities to other technologies fundamental for net-zero outcomes. The modelling and analytical expertise from the ETC secretariat combined with robust discussion between representatives and commissioners creates high integrity independent research products that can be used for a wide variety of purposes.

-

What do you see as the biggest obstacle on the journey to net-zero?

There are many institutional barriers preventing the shift to a net-zero economy at the pace needed. But the biggest barrier I see to solving these is that we don’t collaborate fast enough. Designing and creating energy and industrial systems that offer both climate security and energy efficiency are complex. The ETC sets out how to solve technical issues around emissions and energy use. In reality, decision making that considers trade-offs and commercial viabilities, as well as operational implementation, is incredibly difficult. In many cases, particularly in hard-to-abate sectors, we need the demand and supply side to work in tandem to create an enabling environment for change. That requires unprecedented collaboration, which we need to happen faster.

-

Which are the key milestones you see on the road to net-zero?

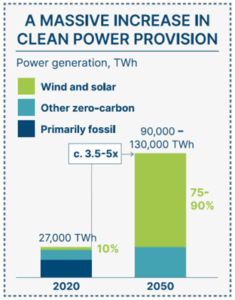

I’d like to see more on renewable power scale up. As we move to electrify as much as we can for a net zero economy we need far more capacity, and it needs to be clean. By 2050, electricity could represent between 60-70% of final energy demand, versus 20% today.

This requires a dramatic increase in global electricity supply, from today’s 27,000 TWh to as much as 130,000 TWh by 2050. This could require the electricity system to grow between 3.5 and 5 times the number of TWh today. With rapidly falling renewable energy costs, it’s the cheapest, most efficient way to decarbonise the economy.

The ETC estimates that wind and solar generation must grow from today’s 10% of total electricity generation to around 40% by 2030, and over 75% by 2050. Annual wind and solar installations must grow 5-7 times by 2030, and over 10 times by 2050.

-

What is the one necessary change you feel most personally passionate about in the transition journey?

I think we need to start having much more open conversations about the role of different segments of economic activity in the transition. There is a major hard truth about transition, which is you need access to capital to do it. The ETC estimates around US$4 trillion per annum on average capital investment is needed in the power sector, building sector and harder to abate sectors such as shipping, steel and cement, to achieve a net zero carbon economy by 2050. Where is that capital going to come from? The answer, of course, is a variety of sources. Previously, we have relied on investors to capture the opportunity provided in renewables and labelled financial products, such as green and sustainability-linked bonds. But in addition some largest companies in the world have strong free cash flow generation which could be directly deployed for transition. We need to elevate the conversation on how the different, and sometimes high carbon sectors today, contribute to the transition, and what a good transition plan looks like for them.