The finance industry is not an energy-intensive sector in itself, but it has a major role to play to drive decarbonisation by investing in low/zero-carbon activities as well as in the transition of high-emissions sectors. But shifting financing flows implies a reset of portfolio management practices and the development of new financing products, including blended finance products.

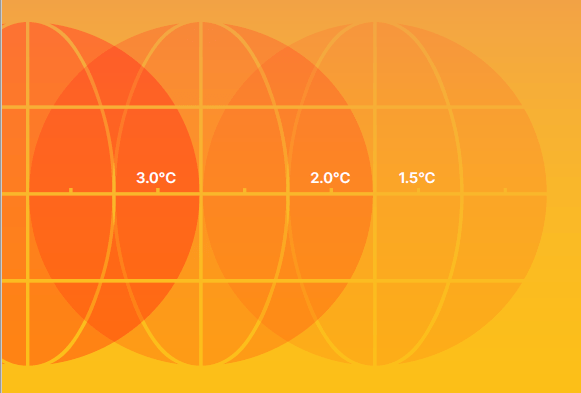

Keeping 1.5°C Alive Series

The scale of finance flows qualified as “green” or “sustainable” keeps growing year on year, driven in particular by investments in renewable power capacity. But these amounts remain much lower than the 1.5-1.8 trillion per annum required between 2020 and 2050 to build a net-zero-emissions economy by mid-century. The power sector constitutes the single most important area of investment for the transition, alongside buildings retrofitting. High-emissions sector, including in industry and transport, will require lower amounts, but different financing routes, to support their transition to lower-emissions and eventually zero-emissions technologies.

The ETC, in partnership with the Mission Possible Platform, aims to orchestrate a productive dialogue between industry players and financial institutions on the transition finance needs of energy and energy-consuming sectors. To support this dialogue, we are mapping investment needs across the energy system, understanding the specificities of different types of investment (in infrastructure, new assets, technologies…) in critical value chains, and identifying potential de-risking mechanisms (including through blended finance).